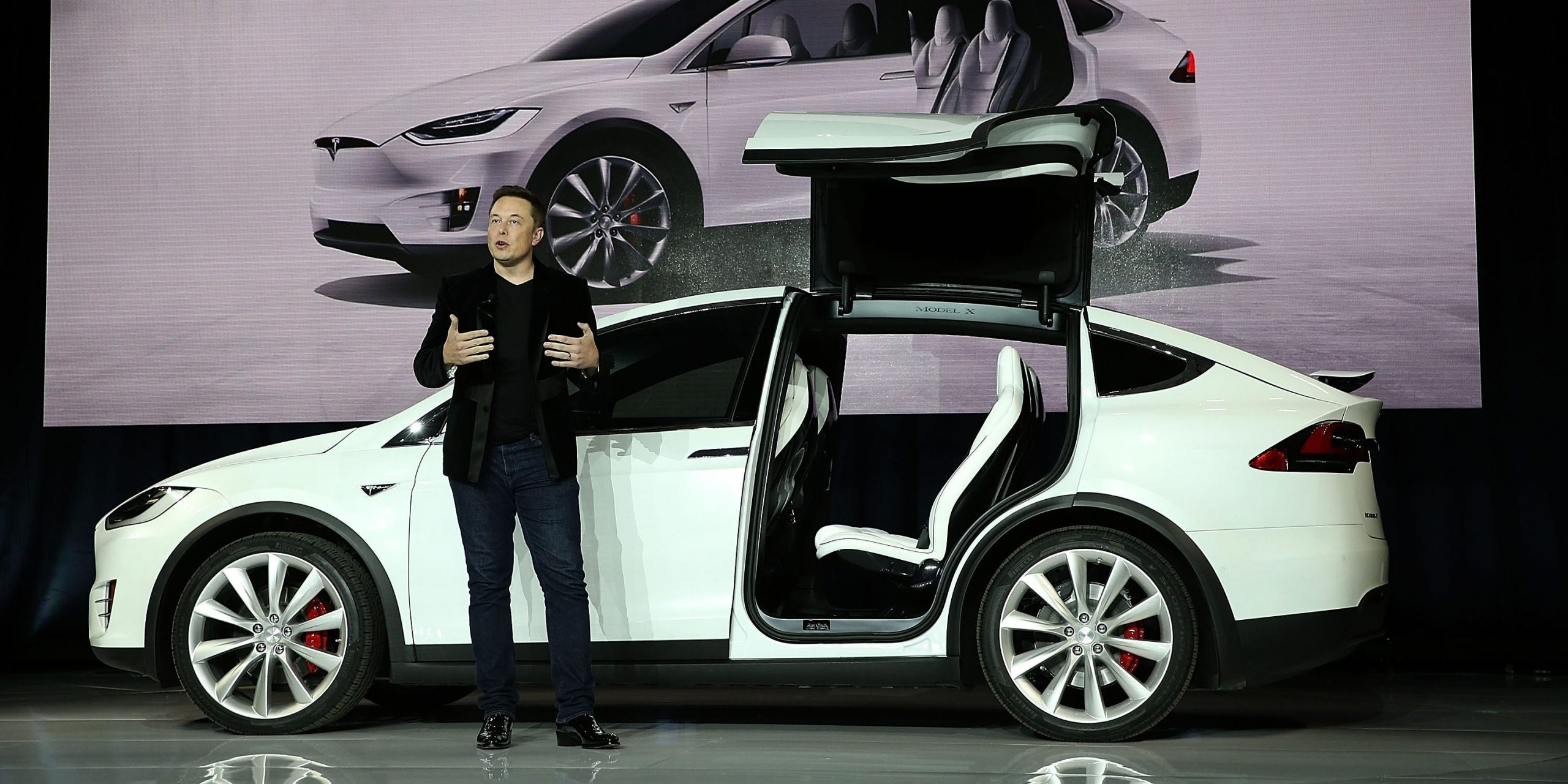

Justin Sullivan/Getty Images

- Tesla stock is heading for its biggest monthly gain in nearly a year with 41% surge in October.

- This comes just days after the EV maker's market cap finally topped the trillion-dollar threshold.

- Shares got a boost earlier in the month from a strong third-quarter earnings report.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

It's been a good month for Tesla stock, and it's shaping up to be its best in nearly a year.

Shares started the month at $775.22 a share. On Friday, the last trading day of October, they were up 2% at 1,098.28 at 1:55 pm ET.

That puts Tesla stock on track for a 41% surge, the biggest monthly gain since November 2020, when shares popped 46% as S&P Dow Jones Indices announced the company would join the S&P 500 index.

The latest jump was driven by a couple of key events.

On October 20, Elon Musk's company reported third-quarter revenue leapt 57% to $13.8 billion, beating analysts' estimates, despite ongoing supply-chain bottlenecks. The stock rallied as much as 4% the following day.

Analysts at Bank of America, impressed with Tesla's results, raised their price target on the stock to $1,000 from $900. The bank noted that a sky-high valuation remained a potential hurdle for further gains.

Then on October 25, a 100,000 vehicle order from Hertz Global Holdings finally vaulted the company to a $1 trillion valuation for the first time ever. Shares gained as much as 11%, making Tesla the second-fastest company in history to hit that milestone, just behind Facebook.

Tesla's $1 trillion feat also reflects a significant premium compared to Apple and Amazon when they reached the same level, Morgan Stanley analysts said in a recent note.

Tesla stock trades at roughly 88x its forward year EBITDA estimate, assuming a $1,000 share price. When Apple hit $1 trillion in August 2018, the stock was around 13.5x. Meanwhile, Amazon was at 27x.

Tesla is also a "significantly smaller company" by revenue and EBITDA than either Apple and Amazon when it achieved the milestone, the analysts said.

They added: "While harder to quantify, we also believe Tesla is garnering greater levels of enthusiasm from investors given its technological dominance (both demonstrated and perceived) vs. the established competition in the vast global transportation market."